Who is Legacy Keeper for? Legacy Keeper is built for financial advisors and their clients who need estate documents, tax, probate, insurance, and execution guidance.

How is Legacy Keeper different than other solutions? Legacy Keeper is AI-first, with a data architecture that enables the most powerful AI functionality while ensuring that user data is kept safe and out of reach from model training.

What is AI First? AI-first means that there is no legacy SAAS infrastructure. Legacy code limits solutions’ ability to offer fully integrated AI agents. The entire experience is built around prompting specialized estate planning AI agents for data extraction and report generation.

How Does Report Pricing Work? Legacy Keeper wants to make our solution accessible to financial planning firms, both large and small. If planners use Legacy Keeper for just a few clients, it makes the service accessible. For larger groups, we will beat any competitor’s price.

Why Are Comprehensive Reports Valued So Highly? Our comprehensive reports utilize a complex collaboration of multiple AI agents that evaluate large amounts of data to provide a truly personalized report for each client. Legacy Keeper comprehensive reports compress a process that traditionally takes days into a few minutes… what is your time worth?

Can Families Use Legacy Keeper Without A Financial Advisor? Yes, individual users can access a standard account to centralize, manage, and collaborate on their estate data. We always recommend working with a financial advisor or financial planner to get the full value of the service. Standard users own and control their data and always choose to collaborate later.

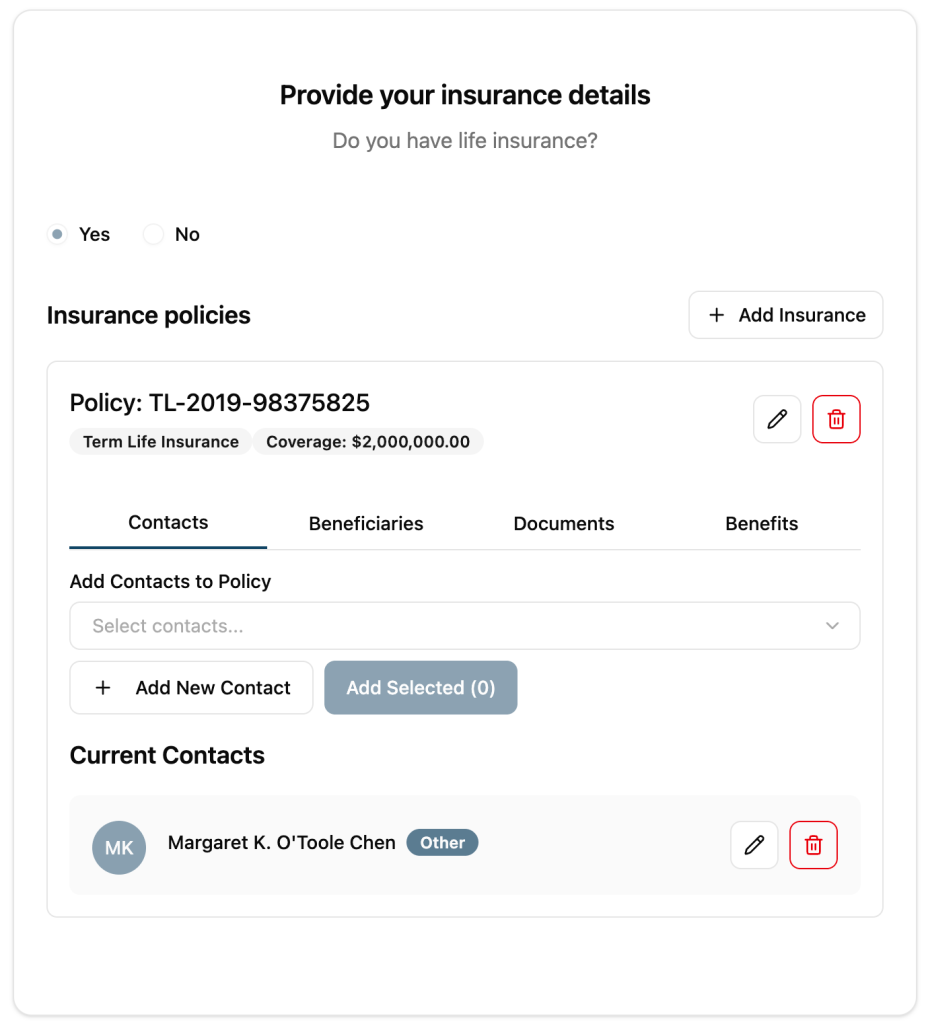

What problem does Legacy Keeper Solve For Families? First, families often have disparate estate data across documents, digital accounts, financial accounts, and insurance details, stored in various locations. This creates a burden for family members and executors when the estate needs to be executed….trust us, we know from experience.

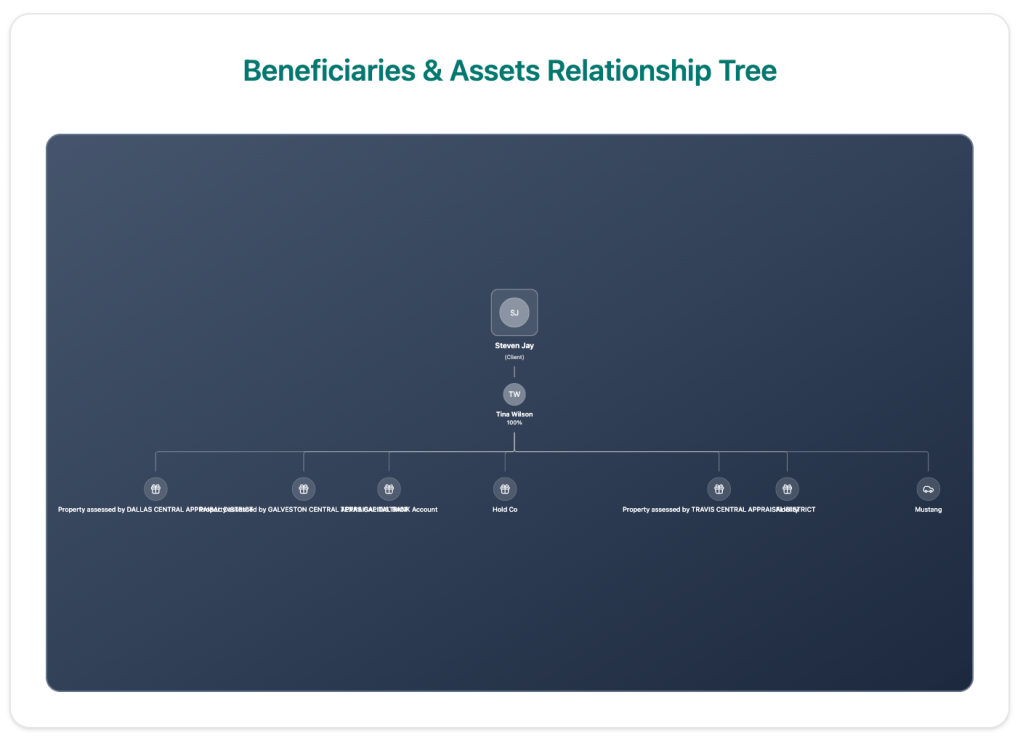

Second, individuals are rarely aware of the tax and probate challenges associated with estate execution. When an estate enters probate, it can take years for heirs to access the assets. Asset ownership structure and beneficiary designation strategy directly impact how much you pay the government at death and how long it takes to distribute assets… we want to save you money (even for smaller estates).

What Problem Is Legacy Keeper Solving For Financial Advisors & Planners? Legacy Keeper empowers financial advisors to support their clients through the complex, time-consuming process of estate planning, management, and execution. Our agents do the data entry, review, and analysis for you, saving hours, if not days, per client. This enables advisors to offer additional value-added services to their clients, save enormous amounts of time, connect with beneficiaries, advise on all assets, identify insurance/end-of-life strategies, and implement liquidity strategies in preparation for a client’s passing.